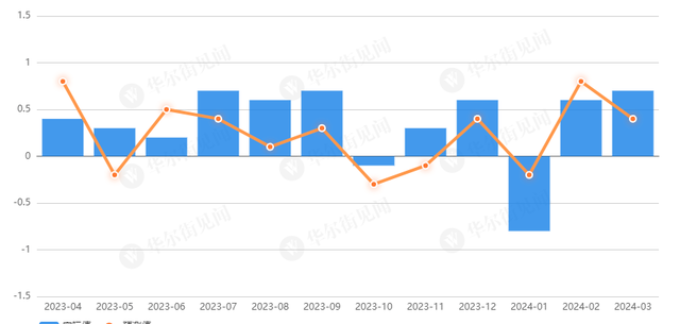

Data released by the U.S. Department of Commerce on the 15th local time showed that U.S. retail sales increased by 0.7% month-on-month in March, higher than consensus market expectations.

Data show that driven by the growth in sales of online products, gas stations, etc., retail sales in March increased by 0.7% month-on-month, lower than the 0.9% growth rate in February, but higher than the market consensus.

Specifically, online product sales increased by 2.7% month-on-month; gas station sales increased by 2.1% month-on-month; catering sales increased by 0.4% month-on-month; building materials product sales increased by 0.7% month-on-month; and health care product sales increased by 0.4% month-on-month. %; sales of automobiles and parts fell 0.7% month-on-month; sales of electronic products and home appliances fell 1.2% month-on-month; sales of clothing products fell 1.6% month-on-month; sales of furniture and household items fell 0.3% month-on-month.

U.S. media analysis believes that March retail sales data show that U.S. consumer demand remains strong despite the current high inflation and high interest rates. A strong labor market and rising wages have promoted public consumption and also shown that the U.S. economy Still resilient.

Data released by the U.S. Department of Labor on the 10th of this month showed that the U.S. Consumer Price Index (CPI) rose by 3.5% year-on-year in March this year, an increase of 0.3 percentage points from February, exceeding market expectations.

Analysts believe that under the current circumstances of rebounding inflation and strong personal consumption and job markets, the Federal Reserve is likely to postpone its interest rate cut plan. Some experts predict that the Federal Reserve may start cutting interest rates in September.